Trails partners with Foresight to bring 1-click fund flows to prediction markets

December 18, 2025

Prediction markets are one of the most powerful tools in DeFi, turning collective expectations into actionable onchain signals. However, participation has been limited by complex wallet setup, chain and token fragmentation, and multi-step transaction flows.

But there’s a solution: Trails.

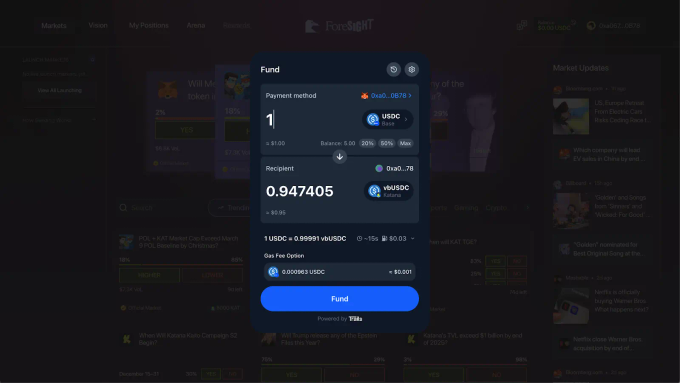

By combining Trails’ universal intents platform with Foresight’s prediction market built on Katana, this integration solves these challenges and makes prediction markets far more accessible. With Trails, users can fund positions in Foresight with any token, wallet, or chain in just 1-click.

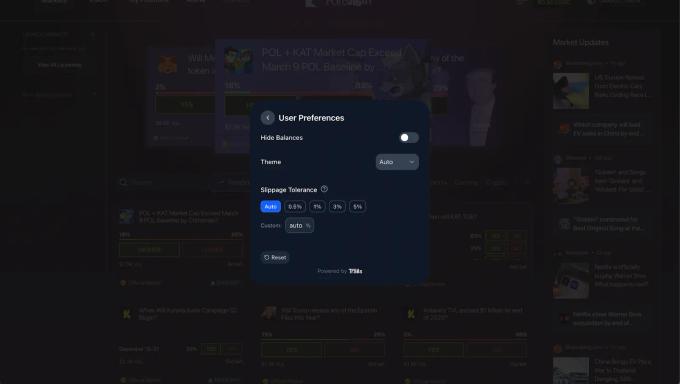

Trails translates each user action into an intent that defines the desired outcome, then constructs and executes the optimal transaction plan behind the scenes, including swaps, bridges, and approvals when required. This allows prediction markets like Foresight to offer a smooth, intuitive experience regardless of the user’s token, wallet, or chain.

Why prediction markets need better funding flows

Prediction markets aggregate belief about the likelihood of future events and turn them into tradable assets. They’re valuable tools for funds, capital allocators, and communities, especially when clear insights into future outcomes are needed. But participation has remained narrow because the operational overhead is still too high for most users.

Prediction markets struggle with fragmented liquidity and inconsistent token availability across chains. Users often hold assets that don’t match the market’s required collateral, forcing them to manually route through multiple AMMs and bridges.

This introduces slippage, multi-step fees, delays, and heightened user frustration. Trails solves this by sourcing optimal liquidity paths in real-time and ensuring the correct asset arrives in the correct contract without the user managing swaps or bridges.

“Prediction markets are only as powerful as the liquidity and UX behind them. By integrating Trails, Foresight can treat every user action as an intent and let our infrastructure handle the heavy lifting of routing, swapping, and bridging behind a single confirmation. Instead of building custom cross-chain plumbing, Foresight now plugs into a universal funding primitive that delivers the right asset to the right contract every time, so they can focus entirely on market design and signal quality.”

Peter Kieltyka, Co-founder and CEO of Trails and Sequence

Trails provides a fund mode that enables users to directly fund applications with any token they hold across any supported chain, including flows that start with a fiat onramp. Fund mode abstracts the limitations of individual onramp providers, allowing users to onramp into any chain or token even when that provider does not natively support it. Trails handles all routing and execution to get value into the market in a single transaction, which is especially important in prediction markets where rapid funding improves liquidity and responsiveness.

How Trails and Foresight solve fragmented liquidity and routing complexity

Together, Trails and Foresight remove the operational and UX friction that slows prediction market participation.

The integration brings together three components:

Privy embedded wallets provide onchain wallets directly into the Foresight UI. This enables users to take part in market activity right away, without first requiring manual set up of an external wallet. In addition, Trails is seamlessly compatible with any external wallet connector or wallet infrastructure such as Privy, enabling an easy and fast integration.

Trails’ funding flows allow users to deposit funds from any token on any chain into Foresight with a single confirmation, including flows that begin with a fiat onramp. Fund mode abstracts the limitations of onramp providers, enabling users to onramp into any chain or token even when the provider does not natively support that destination. Trails then handles routing and liquidity optimization automatically, generating an execution path that ensures the correct asset reaches the correct contract.

Universal liquidity aggregation means Trails can source liquidity across chains and routes so that users are not blocked by siloed assets or shallow liquidity. Trails evaluates liquidity depth, gas cost, and bridge availability to construct an optimized path for every funding action.

“Users want to view and participate in prediction markets seamlessly, without having to think about which chain they need to be on or what token they need to use. They just want quick and easy access, especially in those fast-paced moments where odds shift rapidly. Trails gives Foresight the superpower to accept any token from any chain with 1-click funding flows, meaning users can deploy capital into markets in real time without juggling bridges, swaps, or gas. With Privy embedded wallets and Trails handling liquidity and execution under the hood, we can offer a prediction market experience that feels as familiar as a web2 product while staying fully onchain and performant.”

Eason Chai, Founder & CEO at Foresight

Key benefits for users

- Frictionless funding lets users fund positions with any token from any supported chain in a single confirmation.

- Instant participation is enabled through a Privy connector, removing the need for external wallet setup.

- Automatic routing eliminates manual bridging or swapping; Trails handles all liquidity routing, swaps, and bridges behind the scenes.

- Faster engagement enables users to join markets as events unfold without delays from multi-step processes.

- A familiar experience makes prediction markets feel as simple as funding any typical web2 products.

Key benefits for developers

- Unified integration simplifies cross-chain funding by enabling developers to use a single endpoint instead of managing allowances, slippage logic, chain detection, or cross-chain messaging.

- Better liquidity emerges as easier funding drives higher participation and deeper, more stable markets.

- Higher conversion as a result of embedded wallet setup and 1-click funding flows that reduce onboarding drop-off points.

- Reliable multi-chain infrastructure frees developers to focus on product logic while Trails abstracts chain fragmentation and gas complexity with permit-compatibility.

- Predictable user flows result from Trails resolving multi-step transactions into a single intent with consistent behavior across chains.

1-click crypto: The solution for prediction market funding

Trails turns fragmented, multi-step funding flows into a 1-click experience. Foresight turns future expectations into meaningful market signals. Together, Trails and Foresight deliver a new standard for prediction markets where capital moves instantly, and participation expands far beyond today’s limits.

Powered by Trails. Integrated by Foresight. A better experience for millions.

To learn more about this partnership and how you can get involved, visit the Trails website, explore the docs, and connect with us directly on X, TG, or email. Let’s build together!

→ Request your early access API key

→ Read the Trails documentation

→ Contact our team if you need support

Trails is the universal intents platform for 1-click crypto transactions, enabling anyone to fund, send, deposit, swap, pay, or accept payments in any token, on any EVM chain, using any wallet, and finally eliminating the need for complicated bridges or swaps. Learn more about Trails at trails.build

Written by

Trails team

Related Posts

Trails and Katana create a DeFi experience where value flows naturally and users no longer face the complexity that previously slowed crypto adoption.

CCTP is natively integrated into Trails, providing a low-slippage, high-volume bridge for USDC that powers speedy transfers across supported chains.

Trails is the intent-powered transaction engine that turns fragmented balances into instant liquidity, unlocking the full spending power of crypto.